|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Understanding the Best Fixed Rate Mortgage Deals in 2023Securing a fixed rate mortgage can be a pivotal decision in your home buying journey. With interest rates constantly fluctuating, locking in a favorable rate can save you a substantial amount of money over time. In this article, we delve into the pros and cons of fixed rate mortgages and highlight some of the best deals available this year. What is a Fixed Rate Mortgage?A fixed rate mortgage is a type of home loan where the interest rate remains constant throughout the term of the loan. This ensures that your monthly payments remain stable, providing financial predictability and security. Benefits of Fixed Rate Mortgages

Drawbacks to Consider

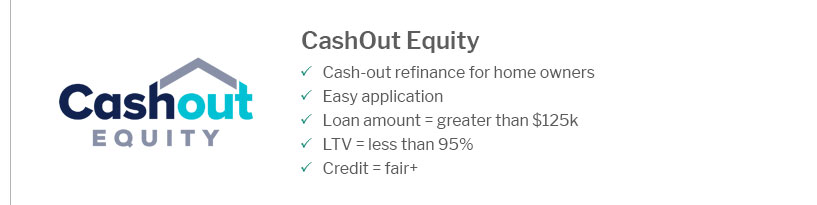

How to Choose the Best DealWhen choosing a fixed rate mortgage, it's essential to consider not just the interest rate, but also other factors like loan terms and associated fees. Comparing offers from multiple lenders can help ensure you're getting the best deal. For those interested in flexible financing options, exploring the best heloc loans could provide valuable insights. Top Lenders Offering Competitive Rates

Frequently Asked QuestionsWhat credit score is needed for a fixed rate mortgage?While a credit score of 620 is typically the minimum requirement, a higher score can qualify you for better rates and terms. Can I refinance my fixed rate mortgage?Yes, refinancing is an option to secure a lower rate or change your loan term, though it's important to consider any fees involved. Are there any government programs for fixed rate mortgages?Yes, programs like FHA home loans offer fixed rate options with benefits for eligible buyers. More information can be found through resources like fha home loans louisiana. https://www.zillow.com/mortgage-rates/

... loan (loan term), while a 30-year fixed-rate mortgage has a rate that stays the same over the loan term. How to get the best mortgage rate. Mortgage rates ... https://www.usbank.com/home-loans/mortgage/mortgage-rates.html

Comparing loan details from multiple lenders will help you determine the best deal ... https://www.comparethemarket.com/mortgages/fixed-rate-mortgages/

Our guide can help you decide whether a fixed-rate mortgage is right for you. Discover the pros and cons, and what you need to know to choose the best fixed- ...

|

|---|